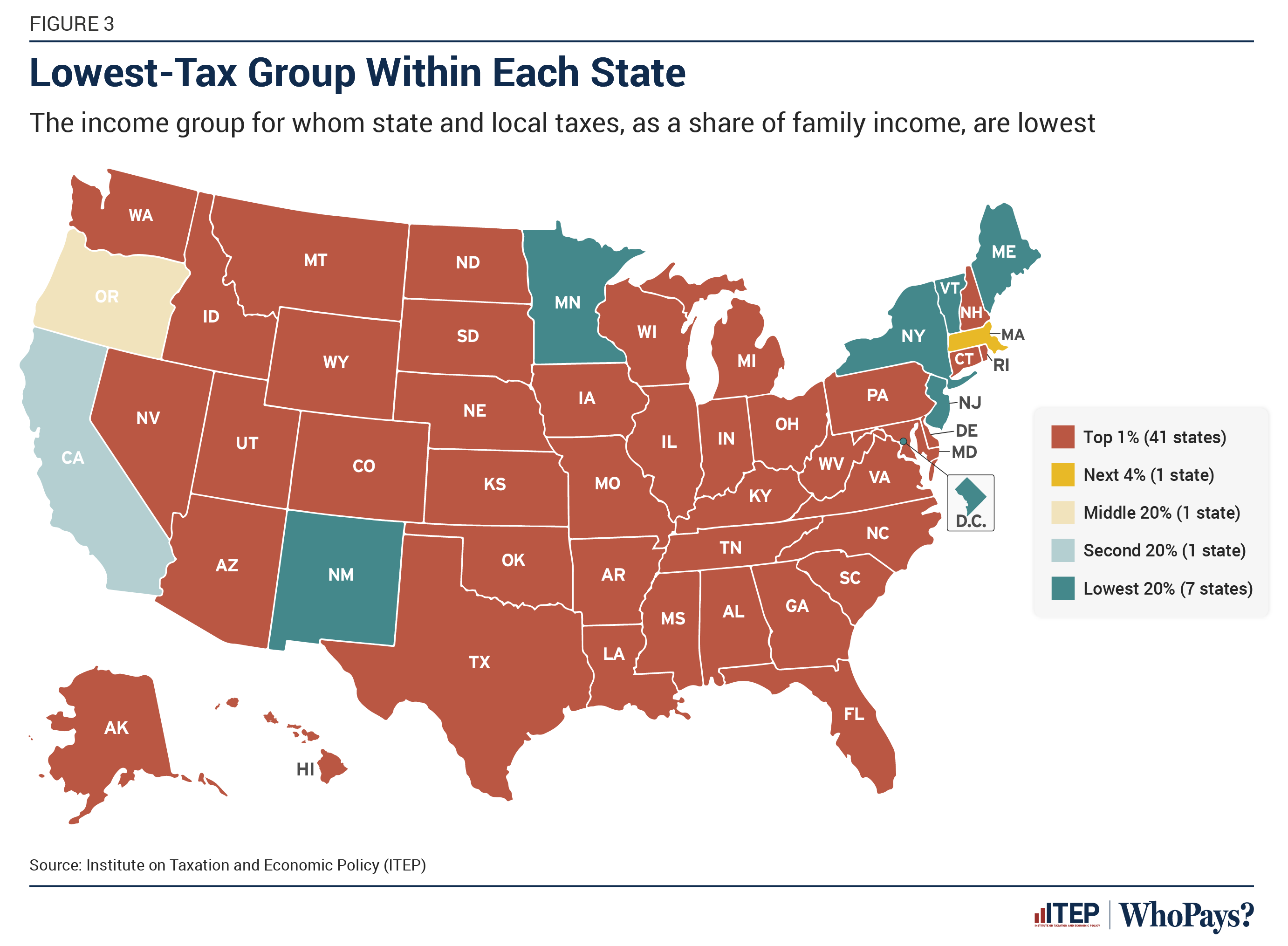

The ones with the absolute most, are, by and large, contributing the absolute least?

Data is Beautiful

A place to share and discuss visual representations of data: Graphs, charts, maps, etc.

DataIsBeautiful is for visualizations that effectively convey information. Aesthetics are an important part of information visualization, but pretty pictures are not the sole aim of this subreddit.

A place to share and discuss visual representations of data: Graphs, charts, maps, etc.

A post must be (or contain) a qualifying data visualization.

Directly link to the original source article of the visualization

Original source article doesn't mean the original source image. Link to the full page of the source article as a link-type submission.

If you made the visualization yourself, tag it as [OC]

[OC] posts must state the data source(s) and tool(s) used in the first top-level comment on their submission.

DO NOT claim "[OC]" for diagrams that are not yours.

All diagrams must have at least one computer generated element.

No reposts of popular posts within 1 month.

Post titles must describe the data plainly without using sensationalized headlines. Clickbait posts will be removed.

Posts involving American Politics, or contentious topics in American media, are permissible only on Thursdays (ET).

Posts involving Personal Data are permissible only on Mondays (ET).

Please read through our FAQ if you are new to posting on DataIsBeautiful. Commenting Rules

Don't be intentionally rude, ever.

Comments should be constructive and related to the visual presented. Special attention is given to root-level comments.

Short comments and low effort replies are automatically removed.

Hate Speech and dogwhistling are not tolerated and will result in an immediate ban.

Personal attacks and rabble-rousing will be removed.

Moderators reserve discretion when issuing bans for inappropriate comments. Bans are also subject to you forfeiting all of your comments in this community.

Originally r/DataisBeautiful

Ah but they're contributing in many other ways! Like, um... uh... let me think for a second...

Hmmm... I'm sure it'll come back to me eventually...

They're contributing more, but less of their percentage. Like 20% of $40,000 is less than 10% of $700,000,000.

It's bullshit. Percentage needs to increase with what you make. It will curb inflation and stop the ridiculous wealth disparity from increasing at an ever expanding rate. All the boomers were doing so great in the 1950's because the wealthy had the shit taxed out of them.

What's fucked is that when you have more, you can afford to lose a higher percentage of it. Like Chris Rock said, "if you're worth $30 million and you lose half, you're probably going to be alright. When you're worth $30 thousand and you lose half, somebody's gonna have to die!".

I am in a high income tax group here in Germany. I am happy to pay almost half of my income in taxes and social security/health insurance, if I see that it gets well invested. We are a society and the stronger should always carry the weaker (both financially and also in other aspects).

BUT: I am really pissed that I have to pay such a high percentage of what I have to work hard for, while those who did nothing but being born into a rich family pay hardly anyything at all. High income taxes should only be a thing when wealth taxes are also high, otherwise it only kills the will to work hard.

Oh hey! Go Minnesota!

What's the deal with Minnesota and Wisconsin? I tend to group them together or associate them with each other but one clearly does things differently. Why the contrast?

From my limited experience, Minnesota is tremendously more progressive than their neighbors who make a really big deal about (poor quality) cheese. I met some younger folks in the Twin Cities who had escaped an otherwise bleak trajectory after growing up in Wisconsin.

If you haven't been, Minneapolis and St. Paul are beautiful cities filled with some lovely people. (They also had some terrorist cells some years back. People need something to do in the cold months, I suppose.) But there's culture and history and decent food and people are really kind and welcoming. And although the winters are cold, getting around in the skyway is a neat idea, despite making the downtown feel like a big indoor mall.

I haven't been to Wisconsin but I know people who have. It sounds like they're trying in some places (Milwaukee) but sometimes trying just isn't enough.

Madisonian here. Wisconsin is a purple state with a major gerrymandering issue. There are deep blue cities of Milwaukee and Madison, and also some smaller cities like La Crosse and Green Bay. Travel just slightly outside those cities, and shit gets MAGA fast. The result is a purple state where it's easy to section off blue and red voting districts.

The Democratic governor has stopped the worst crap coming out of the state legislature, but doesn't have much influence to enact his own agenda.

The state supreme court recently got a liberal majority and promptly shot down the gerrymander maps. The new maps don't guarantee a progressive majority (and in a real democracy, they wouldn't in a purple state), but what should happen is making districts competitive. Legislature candidates will actually need to listen to voters, not just assume they've won as long as they pass the party primary.

Minnesota has the advantage that it has a blue metropolitan area of around 3M people, which is over half the state. Hard to gerrymander that for team MAGA. Madison + Milwaukee metro is around 2M, or around 40% of the state.

Lastly, Minnesota public radio absolutely owns. That may or may not have anything to do with anything else, but I'm super jealous whenever I stream The Current.

Edit: forgot this part. Fuck you, our cheese is internationally award winning.

As someone living elsewhere in the Midwest I have to say...

(Actually that's a lie, Minnesotans are always super nice to us, but damn do they have their shit together in ways I wish Michigan did...)

i'd be ok if we move income tax onto the corpo side of things.

Would mean that it's the companies responsibility to pay that tax, and no longer forces the IRS to go after joe shmoe, who fudged his finger on a 0 while it was still wet.

Or we could also just remove individual taxes, and tax corpos, that's where all money is anyway.

I guess I need to start making a lot more money, so I can pay lower taxes.

How the heck does Oregon manage to have the lowest earners paying more than the median earners without a sales tax?

I expected better from New England.

I'm confused, WA has no income tax, OR has high income tax... As someone who moved from WA to OR, got a raise, and ended up with smaller paychecks I can attest that this doesn't represent everyone accurately

This chart is not displaying income taxes. It is displaying the share of all taxes contributed by income brackets.

For anyone not reading between the lines, taxes like sales taxes and property taxes are designed to disproportionately target those with lower income (i.e., regressive), while income tax is mostly supposed to target higher incomes (i.e. progressive).

And Washington actually has the most regressive tax structure in the US because of these factors.

WA has no income tax, but it does have a state level sales tax. Low income people spend a larger portion of their income on purchases which results in a much higher tax rate.