this post was submitted on 16 Apr 2024

785 points (97.8% liked)

Data is Beautiful

4836 readers

2 users here now

A place to share and discuss visual representations of data: Graphs, charts, maps, etc.

DataIsBeautiful is for visualizations that effectively convey information. Aesthetics are an important part of information visualization, but pretty pictures are not the sole aim of this subreddit.

A place to share and discuss visual representations of data: Graphs, charts, maps, etc.

A post must be (or contain) a qualifying data visualization.

Directly link to the original source article of the visualization

Original source article doesn't mean the original source image. Link to the full page of the source article as a link-type submission.

If you made the visualization yourself, tag it as [OC]

[OC] posts must state the data source(s) and tool(s) used in the first top-level comment on their submission.

DO NOT claim "[OC]" for diagrams that are not yours.

All diagrams must have at least one computer generated element.

No reposts of popular posts within 1 month.

Post titles must describe the data plainly without using sensationalized headlines. Clickbait posts will be removed.

Posts involving American Politics, or contentious topics in American media, are permissible only on Thursdays (ET).

Posts involving Personal Data are permissible only on Mondays (ET).

Please read through our FAQ if you are new to posting on DataIsBeautiful. Commenting Rules

Don't be intentionally rude, ever.

Comments should be constructive and related to the visual presented. Special attention is given to root-level comments.

Short comments and low effort replies are automatically removed.

Hate Speech and dogwhistling are not tolerated and will result in an immediate ban.

Personal attacks and rabble-rousing will be removed.

Moderators reserve discretion when issuing bans for inappropriate comments. Bans are also subject to you forfeiting all of your comments in this community.

Originally r/DataisBeautiful

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

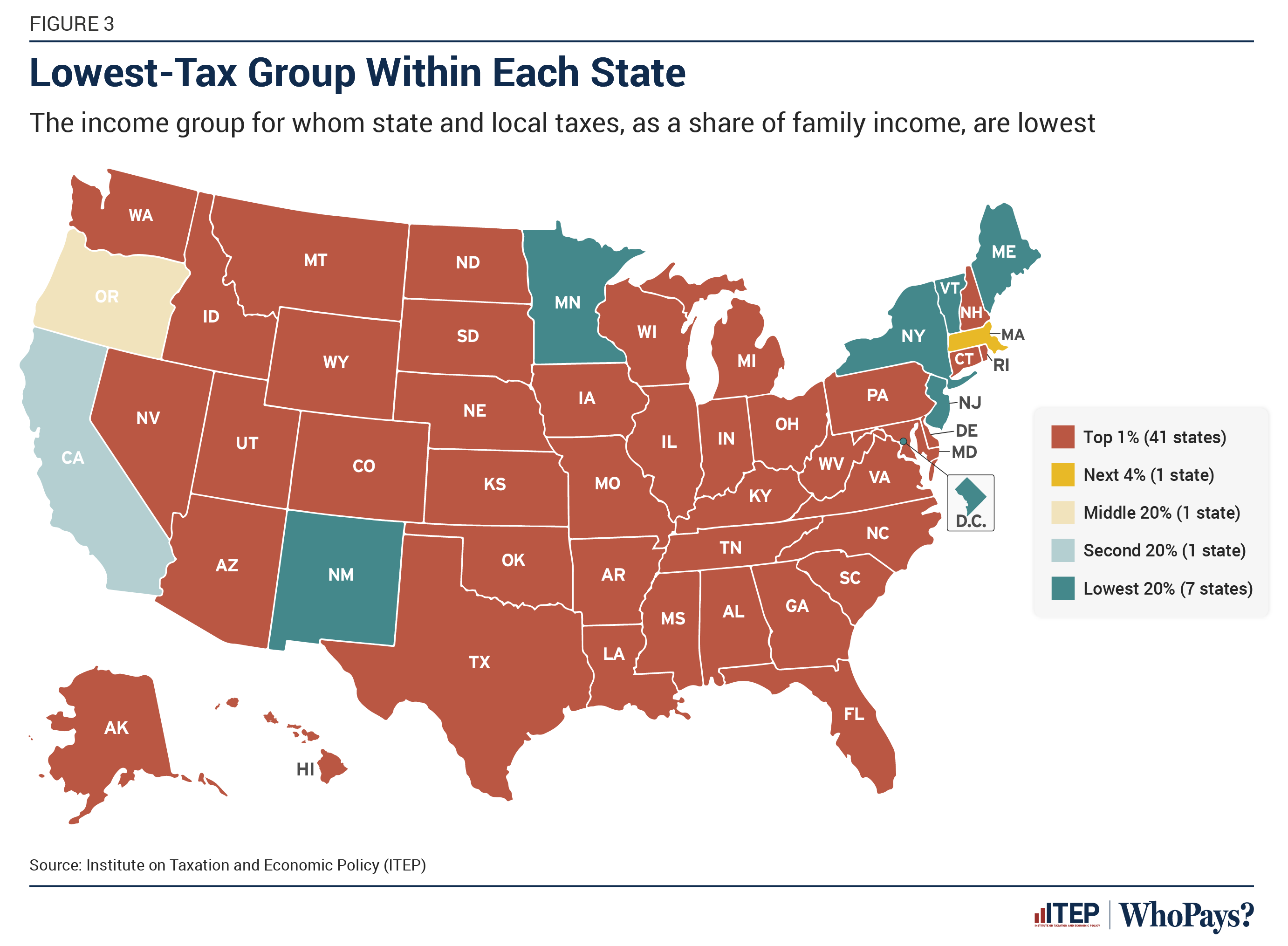

I'm confused, WA has no income tax, OR has high income tax... As someone who moved from WA to OR, got a raise, and ended up with smaller paychecks I can attest that this doesn't represent everyone accurately

This chart is not displaying income taxes. It is displaying the share of all taxes contributed by income brackets.

For anyone not reading between the lines, taxes like sales taxes and property taxes are designed to disproportionately target those with lower income (i.e., regressive), while income tax is mostly supposed to target higher incomes (i.e. progressive).

And Washington actually has the most regressive tax structure in the US because of these factors.

this is the problem with illinois which has a fixed flat income tax in its constitution.

So the red states actually have a less wealthy 1%, and therefore less inequality.

This is a wildly misleading chart at first glance.

Uh, the thing about percentages, as in "the top 1%", is that they are proportional. It doesn't matter if one state has fewer billionaires than another state, that's not what the chart is displaying.

If the average income tax of the top 1% isn't 20 times higher than the average tax of any of the 20% groups, then they'll be paying less overall tax. Because there's 20 times more people in the bigger group.

Or it could be showing that those states have unfair tax rules, which is undoubtedly the case for some of them.

This chart is honestly completely meaningless, because there's no way to know which of those two conditions exist.

It's lies, damn lies, and statistics, poured into a rage-bait map.

Edit: However, I would be intrigued to know how the middle 20% managed to pay the least tax in Oregon.

You could read the accompanying article.

Or even just the text on the chart.

WA has no income tax, but it does have a state level sales tax. Low income people spend a larger portion of their income on purchases which results in a much higher tax rate.

States like California have both high sales tax and State income tax, so that's definitely a worse outcome.