this post was submitted on 09 Jul 2024

45 points (88.1% liked)

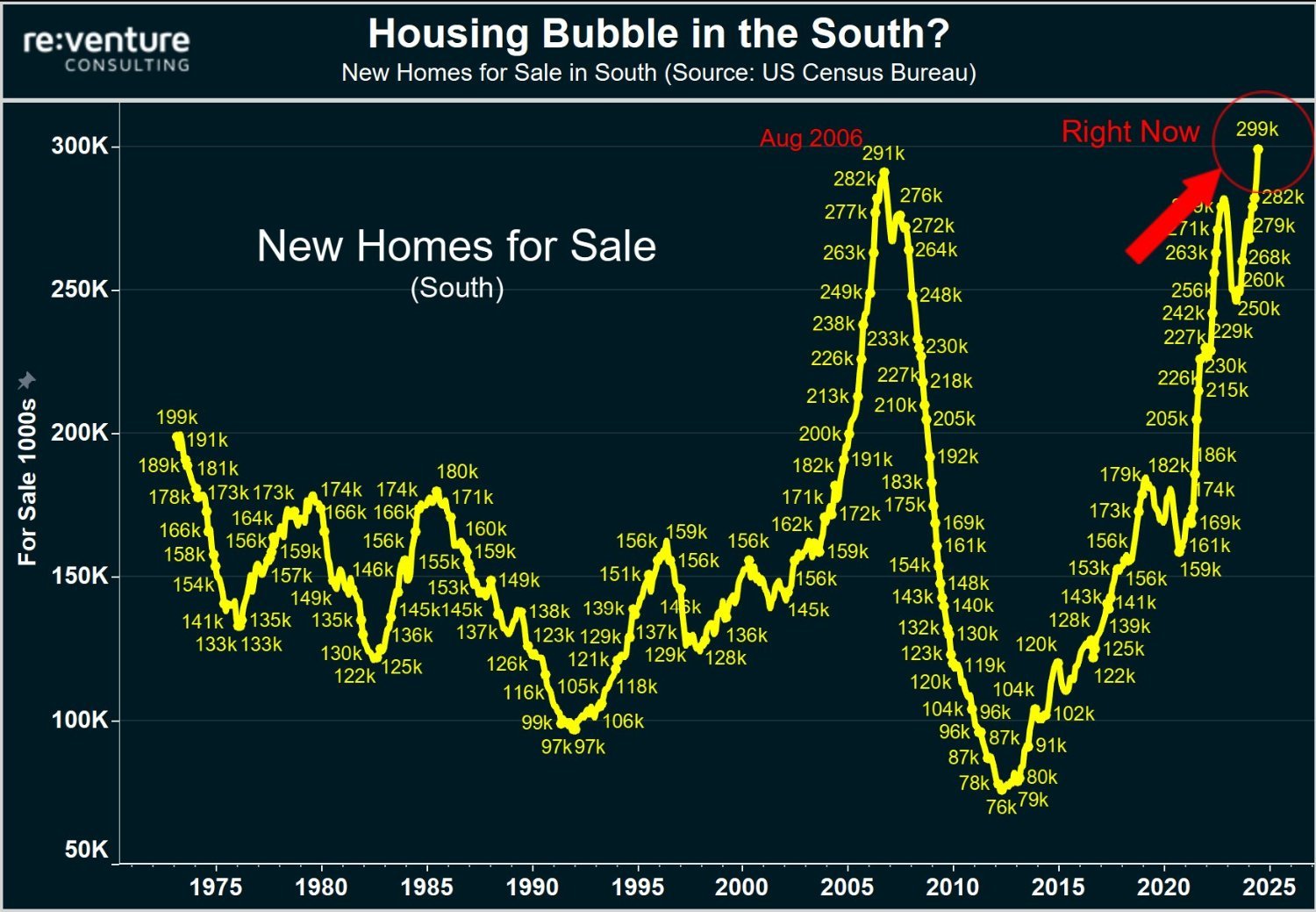

Housing Bubble 2: Return of the Ugly

326 readers

170 users here now

A community for discussing and documenting the second great housing bubble.

founded 6 months ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

I'm decently close to real estate and everything I'm seeing is low low inventory. I'd love for this chart to be true I just haven't seen it.

I am currently in Florida and all I see are empty homes and "for sale" signs. Two weeks ago I stayed in Longboat Key and half to two thirds of the homes in the neighborhood I was staying in were for sale.

Cuz fl is a shithole

And I'm in NW Florida and am only aware of a single home for sale in my hood.

That is the problem with stats that are zoomed out. It would be more helpful if you could visualize which counties and zip codes have the most inventory as well as the median "days on market".

Could this be in an area that's been deemed uninsurable? IIRC there's whole areas where you just can't insure your house any more.

I talk about similar things with my co-workers from time to time. Prices are high, but the risk isnt outside the range of normal, this isnt 2008 where there were tons of bad loans just a gnats hair away from defaulting.

If someone can explain how a bubble can exist right now or what would cause prices to go down, please let me know (or resources where I can read more on it).

I could see a bubble of too many homes for sale and not enough people buying. Not really a huge crash but it would cause prices to ease up. I'm currently looking to buy a new home and the longer I wait the more I'm seeing prices continue to drop.

Except that is pretty region specific. I would understand that being the case in climate evacuation areas where the insurance market has fled. But in most parts of the country I have been led to understand that there are few people trying to sell because they have locked in good interest rates.

Are you in the south US?

I actually don't know. New Mexico so it's kind of south? Haha

I don't think the Southwest is considered part of the South.

I also wasn't sure what region I fell in but thankfully there's a map.

Wait what? You don't know the basics about your home state?

Kind of? Lol education isn't your states strong suit

Proofs?

“My anecdotal experience definitely trumps statistical analysis”

True, but the OP has no data either. Just a pretty picture that they say is based on data.

Looks reasonably accurate to a country wide picture.

https://fred.stlouisfed.org/series/MSACSR#

Thanks for the link. Doesn't look like it's as high as 2008 but getting there. It's tough to buy with such high interest rates right now so not surprising.

Ironically, the fed is getting closer to lowering interest rates, because inflation is finally getting close to the numbers that they want to see. If interest rates drop, then mortgages suddenly get more affordable, which makes the market heat up again.

Strictly anecdotal, but there are multiple land-only properties in my area that have been on he market for years because building is too expensive. The guy that bought a parcel of land right next to ours planned on starting to build three years ago, and then two years ago, and then last year, and each time he ends up not being able to afford to build, because construction contractors are so in-demand right now that their rates are sky-high. So he's paying taxes and HOA fees on land that he can't do anything with.