this post was submitted on 09 Jul 2024

45 points (88.1% liked)

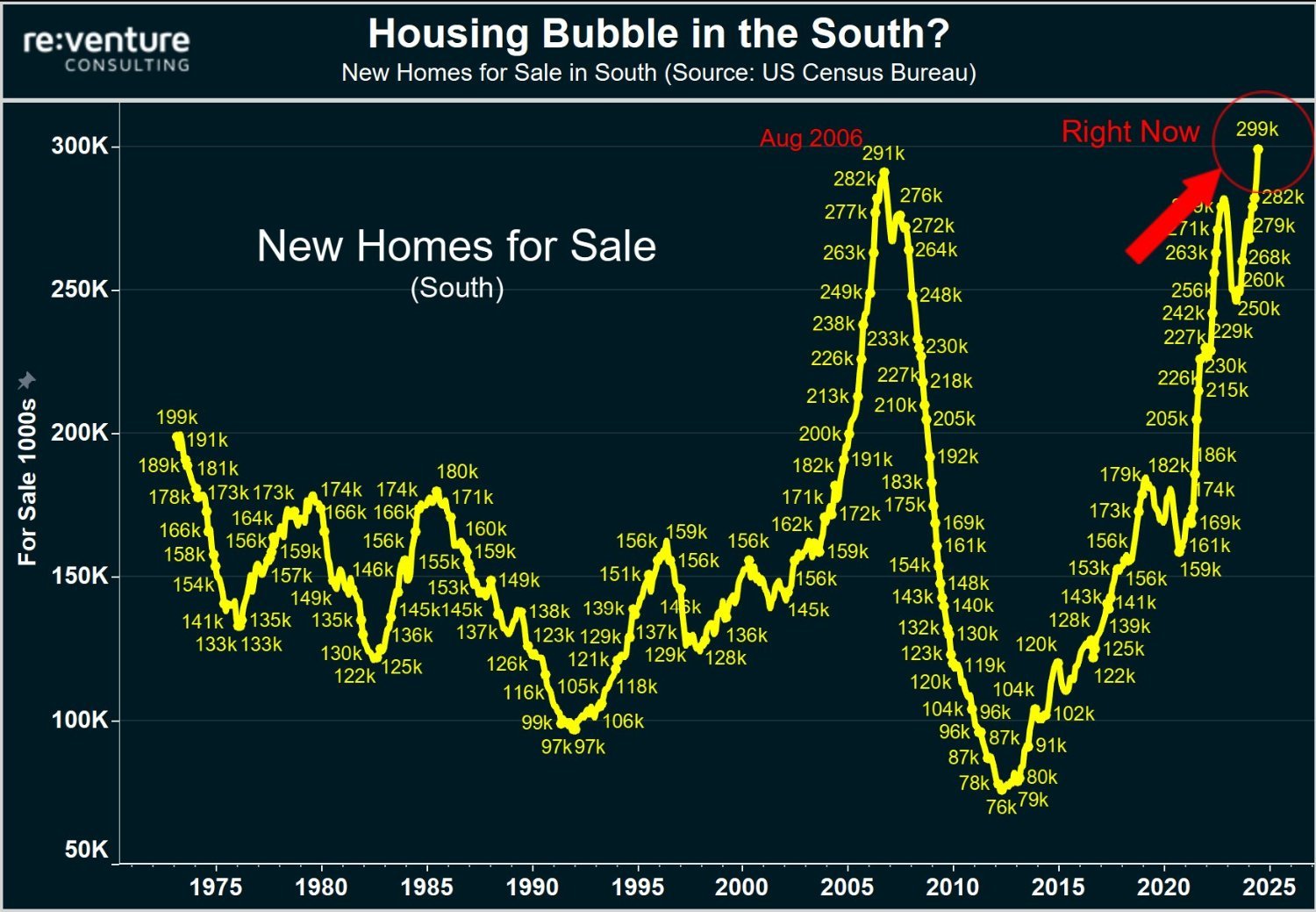

Housing Bubble 2: Return of the Ugly

321 readers

40 users here now

A community for discussing and documenting the second great housing bubble.

founded 6 months ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

There's a ton of exotic DSCR loans underwritten by private equity firms that have HIGH interest rates. They may not be as pervasive as ARMs were in '08 but there's more than enough of them to effect the market if they collapse.

It's a myth that people there's tons of people who won't give up their "4% mortgage". Only well capitalized investors could get that. Most investors paid way over both on price and financing through doggy private equity financing. You don't know what you're talking about.

My b I didn't see you responded back to original comment. If this is common knowledge in that area than I suppose but you still haven't shown where you are drawing this information from and even admit the mortgages now are better than 2008. Not really sure why your getting pissy saying I don't know what I am talking about when all I'm asking is where you are drawing your information from when all that was given is a chart showing volume of houses on the market. Either way hope your night gets better than whatever put you such an abrasive mood🍻

That's untrue, sub 4 was completely available to qualified buyers of "normal" status/income.

For rentals? For borrowers with little to now down? Not really. And these borrowers didn't stop with one rental, they'd get several sometimes dozens. That's why you saw so many real estate Tik Tokers during the pandemic.

Where did rentals come up? I'm discussing purchases.

I don't get information from TikTok, I get it from professionals

Exotic loams liken DSCRs are only used to buy investment properties. Investor demand is what's driving the shortage and exploding home prices. Just like in '08.

Yes many primary residency borrowers got 4 percent on traditional loans. But investors didn't because they were in a buying frenzy from 2019-2022. They couldn't wait for traditional mortgages, these were the supposed "cash buyers" that were infamously waiving inspections and appraisals. The FHA isn't going to let you do that.

Go ahead and get your news from "professionals" who were denying the existence of a bubble at all until this month.

I'm more of a silt guy