this post was submitted on 16 Jan 2024

2483 points (97.8% liked)

Memes

45673 readers

1064 users here now

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

founded 5 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

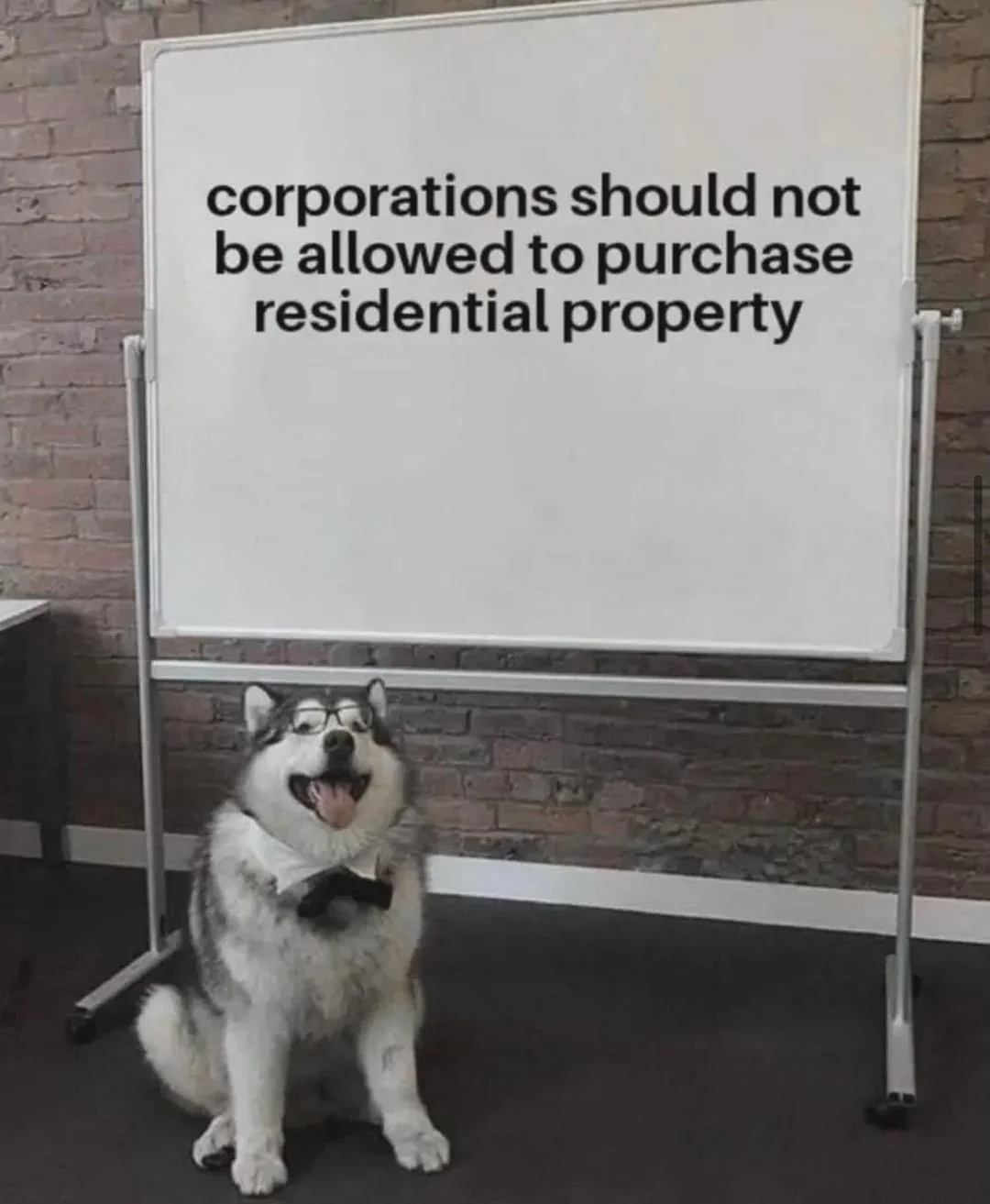

People who own second and third homes aren't even the issue. It's mega corps that literally own tens of thousands of homes each. A better way to go about it is to just progressively tax people more per home. That second home gets taxed at the same rate but any home after is taxed way way way more. If someone can still afford it then that's fine, just more tax money coming in. That and don't let corps own rental properties.

Nope, I said what I said. No one needs a second home. Lots of people need a first.

So what is your proposal? If anyone doesn't get any second houses how it will help other people? Let's say it will make houses cheaper. How is it any good? Lot's of building companies will go bankrupt in days after announcing such law. Can you imagine what type of chain reaction it will start? Also, people can easily need second homes. 1- For where your work is at. 2- For where your homecity is at. 3- For where you are spending your holidays at. It's nice of you to be thoughtful of poor people/people in need but socialist dreams are just what they are. Dreams. It's much easier and logical to make another cake then trying to split a small cake to hundreds of pieces equally.

First of all, I did not suggest that we flip a switch tomorrow that enacts a law restricting home ownership. It's something we can work towards.

But if you think that it's reasonable for someone to own a house where they work, where they originally were from, and where they want to vacation, then quite frankly I don't think we are ever going to see eye to eye.

I think there's an "OR" there, not an "AND". Or are you refusing to see eye to eye with someone who buys a house somewhere because their career moved, then chooses to keep the old one because they were able to rent it? If that's the case, why?

Also, if it could conclusively be shown that keeping people from having a second home wouldn't affect homelessness (which I suspect is true), would you still want to prevent ownership of a second home? If so, why? Just want to stick it to the middle class?

I'm sorry, but considering the top 1% has more than twice wealth of the entire bottom 99% combined, it seems counterintuitive to pass radical reforms that have a larger effect on the lower 99% than the top 1%.

I mean, if I were filthy rich and that kind of thing passed, I would just deed out a single plot of land with a 100-mile or more strip between two 100-acre squares (probably work with other 1%ers to have a co-op of that thin strip of land) and I'd get away with having as many houses as I wanted.

But someone like you or me finds a good price on a little 800sqft second house close to work saving time, money, and environment on commuting? Banned?

Yes.

I will kindly direct you to my very first comment in this thread. Cheers.

Your first comment did not include a "why". But you also don't seem to want to engage. Just throwing out a horrific idea on purpose to troll? I think I'm going to presume you're acting with self-awareness because I don't want to insult your intelligence.

So you do you. I'm out. Not like what you're suggesting will ever happen for people to lose sleep over it.

People who have different world views than you are not automatically trolls. You'd do well to consider that.

What about vacation homes? They are quite common in countries that used to be in the soviet block.

Or mountain huts

It helps other people because more units available leads to dropping prices.

I don't think there is any data to back that up.

1st year econ says something supply demand curve something something price. But that's not true in practice

In Texas, your property tax is already somewhat two tiered. Your first home is taxed as a homestead and you get an exemption on part of the property tax. If you own a second, third, etc you have to pay the full amount and the annual increases are not capped. Im not 100% sure on the specifics as I don't own more than 1 though.

Your not homestead house will be ~$2,000 higher in taxes than if it were not homestead. Exemption is up to $100k I believe, so I'm going off roughly 2% of exemption for additional taxes.

And all that higher tax cost is passed directly on to tenants

At some point the taxes would be so high that nobody could afford to rent and the owners would lose money forcing them to sell. Which is fine. Just gotta make the taxes higher for more than x houses.

Bingo. Most of these tax schemes will hurt the renter, not the landlord.

basically tax it so much that anything beyond a third home is impossible to generate income from.

Logarithmic scale of increasing property tax rate

Not sure if you actually meant logarithmic or exponential. An exponential tax rate would mean that the more you own the next unit of value would be a lot more in tax, while a logarithmic tax rate would mean that the more you own the next unit of value would be a lot less in tax. See x^2^ versus log~2~(x) (or any logarithm base, really). The exponential (x^2^) would start slow and then increase fast, and the logarithmic one would start increasing fast and then go into increasing slowly.

https://www.desmos.com/calculator/7l1turktmc

We already do this with a homestead exemption in Texas. Problem is, all the rent houses don’t qualify for the tax break, so the tax burden is passed on to the renter market / the tenants.