this post was submitted on 12 Dec 2023

1371 points (98.4% liked)

A Boring Dystopia

9745 readers

415 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Sorry to be that person but this doesn't make sense for a couple legitimate reasons.

https://sh.itjust.works/comment/6179467

For sure BS the DoD isn't really improving. Yet this is an apples to oranges comparison.

It's not about taxes, not really. It's the hypocritical and one-sided scrutiny of citizens vs corporations and the military industrial complex.

It's still wrong. Even when not about taxes directly.

It demonstrates either ignorance about government responsibilities, ignorance about GAP, or combination of both.

People passing this around should do better to come up with an applicable comparison regarding oversight the IRS has. There are many examples.

But the IRS isn't the GAO. Auditing the DoD will never be something the IRS handles.

Ok, so where is the missing 2 trillion dollars? You seem to be missing the forest for the trees. It's about hypocrisy, not the highly specific functioning of an inept governmental office.

Edit: I'll spell out the hypocrisy. What happens when you fail an audit? You're forced to pay back the money. What happens when the Pentagon fails their audits? Literally nothing. The 1990 bill has no penalties for failing, none.

You have literally no sources for any of those claims and are just talking out of your ass.

Ok, so where is the missing 2 trillion dollars?

That's for the GAO to figure out. Not me or the IRS. The IRS is already understaffed and funded as is. And both the IRS and DoD are Executive branch. That's why the audit authority rests with Congress to provide checks against Executive authority.

You seem to be missing the forest for the trees. It's about hypocrisy, not the highly specific functioning of an inept governmental office.

If it's only about hypocrisy there are still better examples. The DoD doesn't generate revenue so there isn't anything to tax. Meaning the IRS shouldn't be involved.

If to call out the DoD make it about how they expect this level of accountability with their own suppliers and staff that they're failing. If to call out the IRS it could go with numerous options unrelated to the DoD.

As is it doesn't make sense.

I don't know how else to say this. It's not about specific agencies applying what penalty or anything else like that. It's the fact that there are no penalties for the DoD for failing an audit.

So about my prior comment on ignorance of the government. Congress owns making penalties happen. As stated, this post suggests it's the IRS not doing their job.

You're welcome to come up with an alternative interpretation of what's plainly stated. But we can do better than misrepresenting the issues this post does a crappy job of bringing up.

Ok, I see where you're coming from. I looked past the error to see the point of what they meant. You're stating the obvious that the IRS isn't involved with government agency audits. We're arguing about 2 different things.

It's not obvious unfortunately. Otherwise I wouldn't bother.

People have been repeating versions of this same post across social media for weeks. With common replies asking why the IRS isn't doing anything about it.

I have a follow up question, sorry to re-derail this, I'm also from elsewhere so have no idea about freedom financials and audits:

Even when the GAO completes their audit, will it really be of any use if every other line item reads "classified": $stonkbucks?

My reading: Uncle Sam’s Ledger Logic:

On the other side of the meme, why shouldn't money obtained via a 3rd party platform need to be reported to the IRS? I don't understand the complaint.

Is your business suddenly special and tax-exempt just because you sell your custom knick-knacks on Craigslist on or accept venmo for your at-home dog grooming service or whatever?

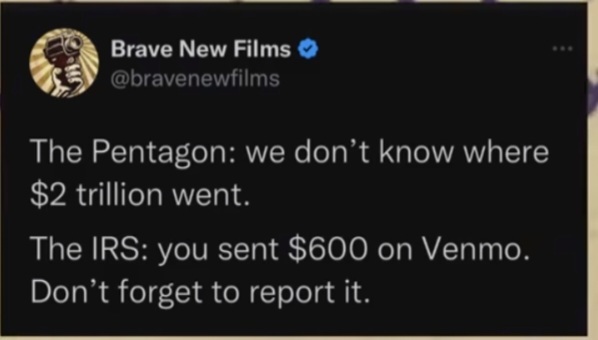

The joke is that they hold taxpayers to ridiculously high standards, to the point where the concept of $600 of unreported income is something the government will harass you for. While they can just accept billions of their own spending going unaccounted for without a second thought.

And yes someone running their own small business struggling to survive is not worth taxing. Even if they were paying "what they owe" they would contribute nearly nothing compared to the rich people. And suffer far more for it.