I'm more shocked to learn that MV has opened for 25 years already... Now I feel old...

port888

Kubuntu on my main while I set up my Proxmox VE home lab. Plasma is superbly customisable, but there's something about Gnome that's so pleasing to the eyes that makes me look up ways to make Gnome work for me.

I have decided that xRDP is how I want to access my VMs (the only protocol that I'm able to reliably get multi display to work without additional configurations), so that's my bare minimum requirement for now. The test Debian VM I had straight up would not install the xRDP Easy Install script.

Switched to Linux (on my spare laptop) because that's what the programming tutorial I was following at that time recommended (though I've had experience with Ubuntu on and off before this). Such a delightful experience setting up programming stuff on Linux compared to Windows (I know WSL exists, but I like to keep my environments separate). Now my Linux spare laptop is my main PC, while I've barely turned on my "main" Windows laptop lately. Helps that my entertainment is mainly YouTube and not much gaming, though I played a few steam games on it before with a few quirks.

Big news in sports today: Shohei Ohtani goes to the Dodgers!!!

Yep, the currently available PRS funds are in general not great investments for the price you pay (in TER), by virtue of them being mostly Malaysia-centric stock pickings. They are basically Malaysia-themed mutual funds. I've not studied every PRS fund, but most of them do not beat their declared benchmark (most benchmark to FTSE-Bursa Emas Index), or they put a very low bar for themselves (an index comprising a combination of 12-month FD board rate and KLSE) despite being an equities fund.

I've been max-ing out my PRS allocation for the past 3 years. The moment the tax relief for this ends in 2025, I will not be putting a single sen in it anymore.

On Versa PRS, I'm more concerned about the longevity of the platform. At the end of the day Versa is owned by Affin Hwang Asset Management (AHAM), so if Versa does not survive the robo-advisor war and is forced to close down, you most likely only need to relearn where to access it (most likely through AHAM's present own fund investing portal).

The typical place ppl do their PRS shenanigans is on FundSuperMart (FSM).

You're chasing for Versa's 12% p.a. promotion on Versa Save? It's basically RM100 for your troubles (12% for December on RM10,000). RM100 is 3.33% of the RM3000 PRS allocation, or 2 years' worth of management fee. Better than nothing lah I guess.

https://www.ppa.my/prs-funds-information/

There's no best. The ones with lowest management fees often have a sales charge. So you gotta evaluate whether you want to pay the fees up front, or let them chip away per year.

Take for example

AHAM PRS Growth -> No sales charge. 1.8% p.a TER.

AMPrs Growth D -> 3% sales charge. 1.5% p.a TER.

The 0.3% TER difference will take 10 years to equalise. At face value, it's better in the long run to pay the sales charge straightaway. However if one were to consider inflation of 3% per year, that initial 3% sales charge will be equivalent to 5.4% after 20 years (assuming the 3% sales charge you put into a 3% p.a FD, while the rest is invested at 0% growth).

The 'growth' style funds also tend to have higher TER, possibly due to the way they generate the "growth"-like performance by frequent trading.

Long story short: tax relief is not free, it's being paid in the form of the TER and underperformance of the PRS fund you subscribe. Pick one and don't look back.

Having just finished the latest Kluar Sekejap episode with Tun M, I must say, that guy sucks.

Someone probably feels the same about a hobby you're obsessed about. Just the nature of hobbies.

They aren't doing this for the school students.

lol I've been observing how the various news outlets report this item. Almost all of them demonstrated that they do not understand what's going on. A "shutdown" is basically when a plant stops operations to perform periodic maintenance or upgrading works. Using the word "temporary" is just a cover-ass phrase to say "I think they are going to end businesses (because that's what I think that word means, and also that will bring in the clicks), but their press release says it's not long term...? Let's be safe and cover both cases." Shutdowns are by its very own nature, temporary. It's like saying "permanent death". Inb4 "transitory inflation".

Paling funny is one headline that reads along the lines of "Lynas shuts all operations in Malaysia...". I kek.

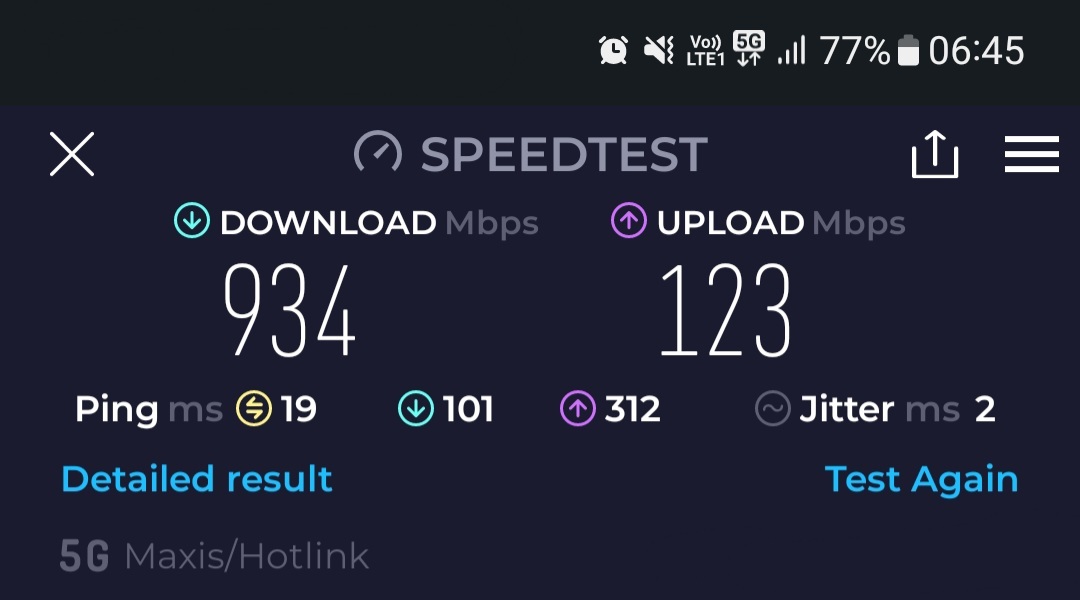

Yesterday kutuk why 5G, today stimmix with Hotlink 5G. Though annoyingly it keeps switching between 4G and 5G when I'm sitting still, and office smack on the center of KL.

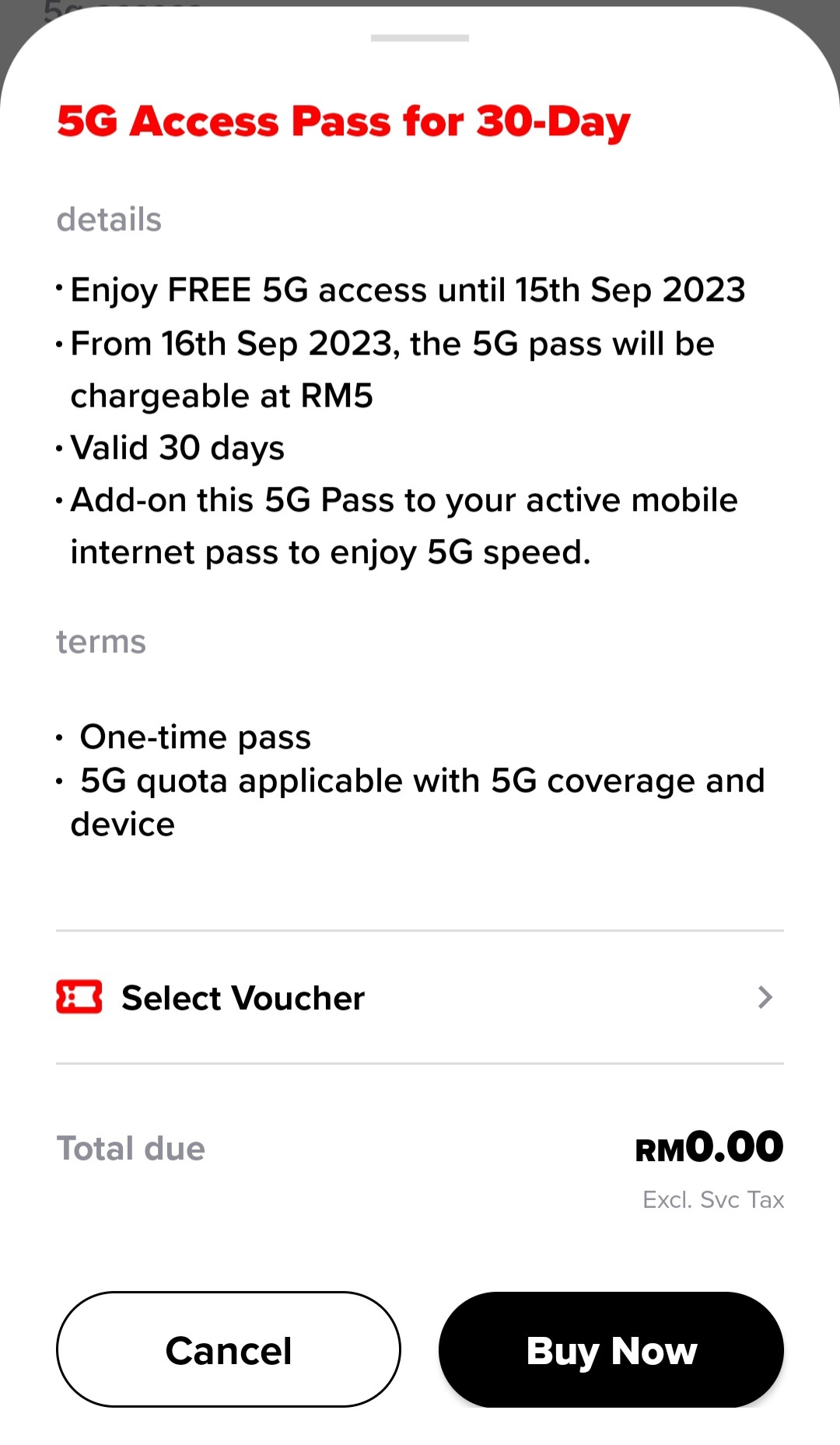

Hotlink/Maxis finally has 5G, but at RM5 per month. Whatever happened to 5G being cheaper than 4G or whatever propaganda it was before this? If cheaper, why need extra pass just to access the network...?

Try reheating on low power for longer duration, like 10mins or more.