They actually teach people in school now that having money in reserve at a company is bad because it's not helping you make money.

Those words have literally come put of my future brother in laws mouth, who works in the banking industry. He's been put of school a year or two, and has essentially said, if you have a rainy day fund as a company, you're not maximizing your potential revenue (or some other hogwash like that)

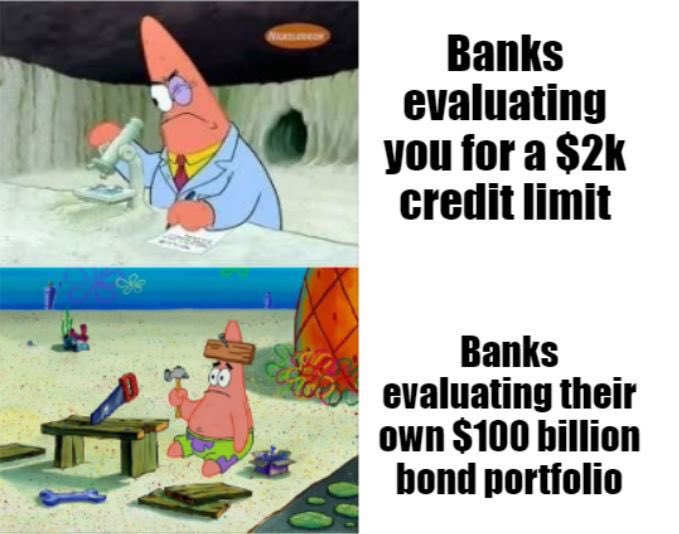

And then we wonder why the financial industry has a boom bust cycle.