this post was submitted on 08 Jul 2024

667 points (96.9% liked)

2meirl4meirl

922 readers

481 users here now

Memes that are too meirl for /c/meirl.

Rules:

-

Respect the community. If you're not into self-deprecating/dark/suicidal humor then this place isn't for you. Kindly just block and move on. This is just how some of us cope.

-

Respect one another.

-

All titles must begin with 2meirl4meirl. This is for multiple reasons. One is just so you can be lazy with titles but another is so people who aren't into this kind of humor can avoid it.

-

Otherwise just the general no bigotry, no dickishness, no spam, no malice, etc stuff.

Sidebar will be updated when I feel like and considering I'm Sadboi extraordinaire we'll see when that will be.

founded 11 months ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

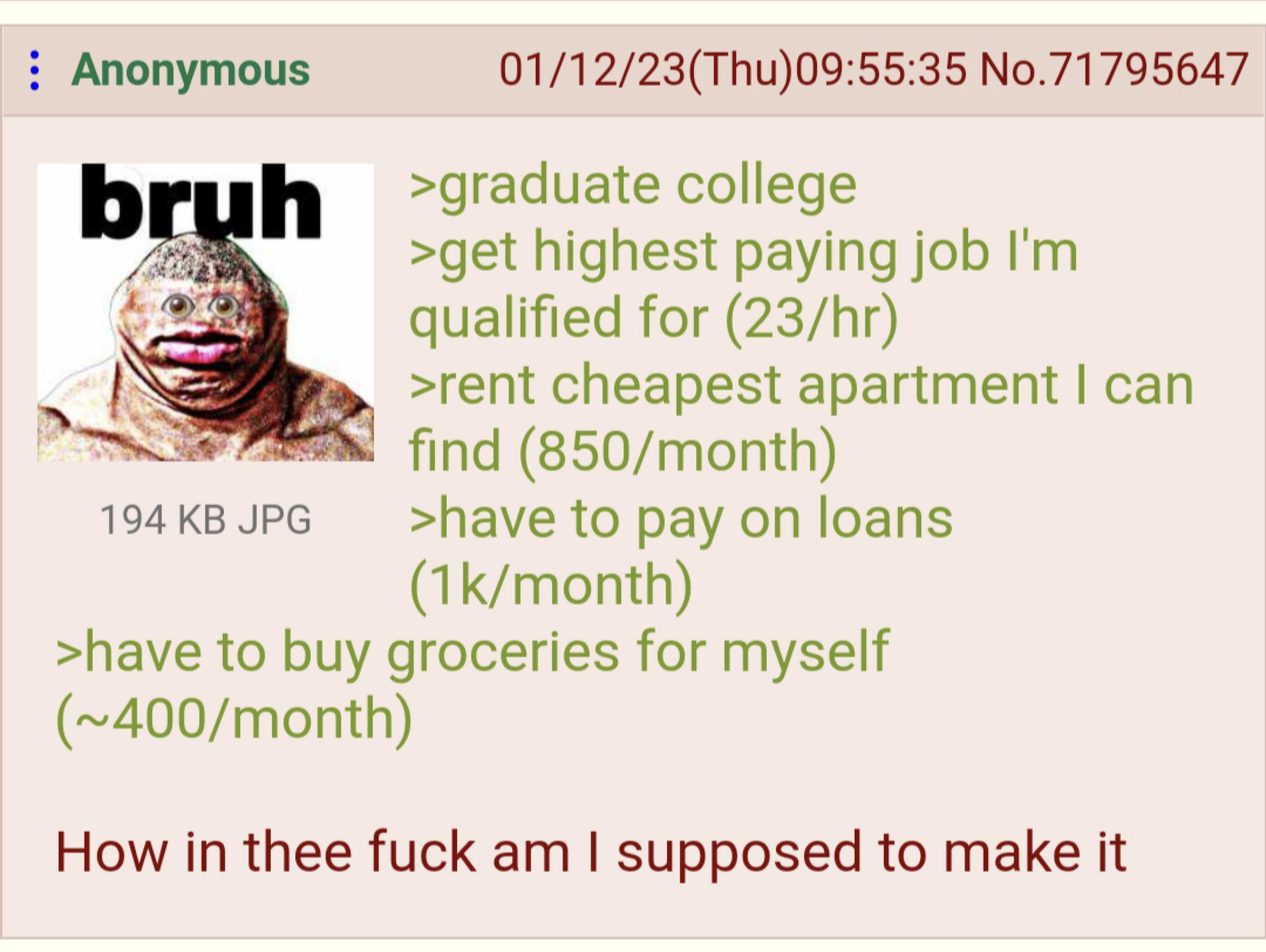

numbers don't check out

lists $2250 expenses.... 100 hours of work per month would cover it

I know they have other expenses, but they failed to list them and failed to make their point.

100 hours of work if the money is tax free (it's not). Taxes take about 40% of your gross income so on $23/hr hr can't afford the listed bills.

By my estimation and IRS calculator, his tax liability is probably under 20%. Probably. This assumes about 15% is being taken out for healthcare and retirement however, so yeah, the net paycheck will be approximately 30-40% lower than gross.

I'd estimate OP has $440 a month left over after all the list expenses.

$440 per month to pay for gas, utilities, phone bill, insurance, incidentals, etc. You can forget about savings completely.

I don’t think OP is too far off the mark.

Use this tax calculator; it includes FICA, state taxes, and local taxes:

https://smartasset.com/taxes/income-taxes

No one is paying 40% total tax rate unless they are single, make $350,000+, and live in a high tax area (NYC, San Francisco). If you are married, you have to make at least $800,000 to pay 40% overall.

That's what I used. Still some question about how much nontaxable retirement/Healthcare as well as what the state taxes would be. I estimated $5,700 in federal and $1000 in state. Based on 10% to retirement and $2400 a year for insurance, right off the top, and a 3% state tax.

Nowhere in the USA will you be taxed 40% of your income, I’m amazed such a blatantly obvious statement is being so heavily upvoted

Look through the thread and you will see people showing their work and coming up with similar numbers. 40% was a rough estimate off the top of my head. Figures from a recent paystub of mine: gross income of $2700.80, net income of $1774.41. My deductions are more than just taxes, but regardless that is an effective reduction in pay of %35.31. This is a real life figure that the others may be similarly subjected to, as opposed to the numbers you get out of a calculator.

I'd be glad if rich people paid 40% tax.

But it is closer to 4%, while they could easily pay 95%.

Taxes are not the problem. They are necessary for a functioning society. And if other people avoid paying taxes, that means YOU will have to pay more. Because the money will have to come from somewhere.

I'd gladly pay 90% taxes if it meant the rest of my expenses were provided by the government.

In the UK if you earn over £100k you effectively get taxed 60% (using PAYE)

I'd happily pay 75% if it meant public services were actually effective, but we have the double whammy of high taxation and crumbling services - that's what over a decade of conservative rule does... Here's to the next 4 years!

I've not seen anyone so far in this thread quoting 40% taxes. Looking at

I just pulled my paystub (single income household) and I'm at 37% of income going to taxes and full benefits (including 7% to my 401k) covering my whole family while not making much more than the OP