this post was submitted on 15 Apr 2024

610 points (98.1% liked)

Political Memes

5444 readers

3119 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

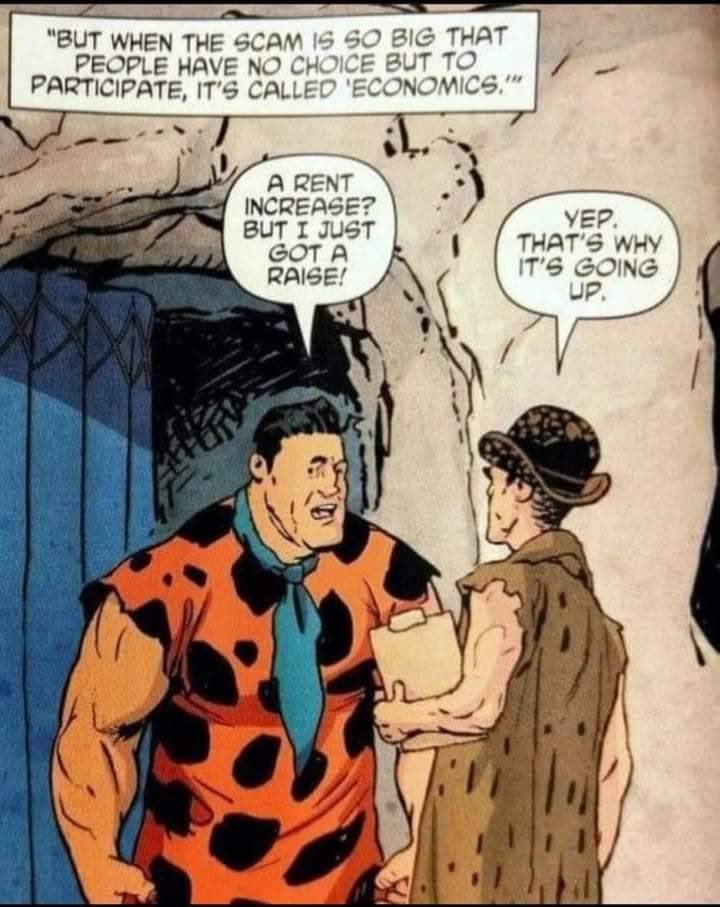

Inflation is when rich people think you've got money you're not handing over.

This is not what inflation is. Inflation is bad for rich people because the value of their wealth hoards decreases, but what this actually is (wildly increasing rent and prices of groceries) is just (legal) profiteering if anything.

Edit: it appears I was mistaken. Please disregard this post.

Rich people aren’t just hoarding money in a bank like Scruge Mcduck, unless they’re not very smart. If most of their money was tied into bank bonds that didn’t out perform inflation, then it’s bad for them. But if it’s tied to business stock or ownership, then those stocks are now worth more money for one to be willing to give up that stock. Inflation benefits some types and hurts others.

Thanks! I’ll edit my post with this knowledge in mind.

Kudos to you for not doubling down!

You were not mistaken though. Read my comment about net debtors benefitting from inflation.

Your general idea of inflation being bad for those who hold money is correct. Stocks and real estate don't counteract inflation, they are just less affected by it.

Wealthy people are net lenders because they usually hold more bonds than they borrow. That means they are negatively affected by inflation.

This isn't true. Wealthy people do not hold more bonds than they issue. Berkshire Hathaway for example has less than 1% of their funds invested in bonds

The mantra is that bonds are part of diverse portfolio but this for people who are investing in retirement funds.

Bonds are often held for this purpose. They are a useful for an income steam but they are not where the majority of anyone's investments are held because they are not fast growers. Furthermore, bonds are a hedge against inflation because they grow faster when inflation is high which obliterates your entire argument.

This is incorrect and harmful to people who read it. See below:

https://www.investopedia.com/articles/bonds/09/bond-market-interest-rates.asp

Still not true. I Bonds.

Do not trust anyone who uses investopedia as a primary source on what or how to invest. It's magazine level content. The equivalency here is using popular science as a reference for how to engineer a bridge.