this post was submitted on 11 Jan 2024

1112 points (93.2% liked)

memes

10278 readers

2842 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

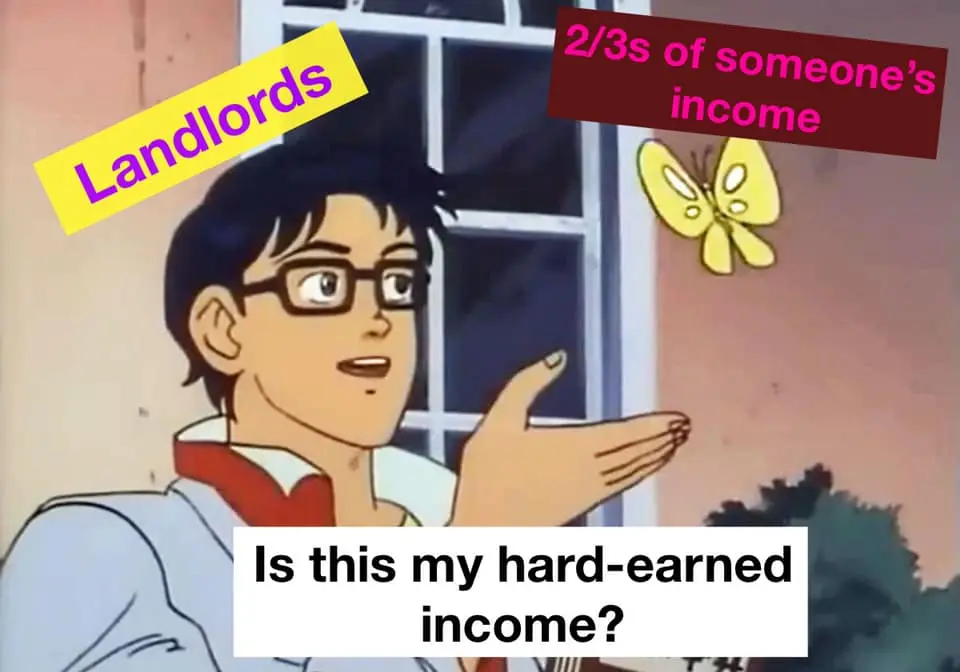

We're talking about landlording, not what they did to afford to start landlording.

They didn't make the building and, while they put down the first payments, their tennants are the ones paying for it.

That's not creating wealth. That's not work. That's living off the wealth created by others.

Like all other passive income, the challenge is having enough money to start with.

Once you get past that point, it IS easy, but due to the inherent inequities of capitalism, getting there is literally impossible for the vast majority of people.

It's clear there is a fundamental misunderstanding in the amount of capital required to own an investment property without first living in it as a primary residence for a few years.

If one were to purchase a property with the expressed intent of immediately renting it, most banks will require at least 25% down with no option to pay PMI to cover the difference. That's an insane amount of money to put down just so the landlord can make a negative cash flow for the first 10 years. If an investor has that kind of money, and still want to be involved in real estate, they should buy a share in an apartment complex where the margins are more favorable, and the property actually has a positive cash flow.

Thus nearly ever single family home was purchased initially as a primary residence, with the intent to live there. But then by some circumstance one way or another they needed toove away. Selling a home will cost you 10% of the home's value in fees. So if that person has any intent to return to the home in the future, it's better to eat the temporary loss and rent out the property.

However you dress it up, charging others for shelter isn't creating anything. It's profiting off others.

Besides, the vast majority of tennants rent apartments, not houses, so don't pretend that your very specific example is the norm.