this post was submitted on 11 Jan 2024

1112 points (93.2% liked)

memes

10322 readers

2053 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

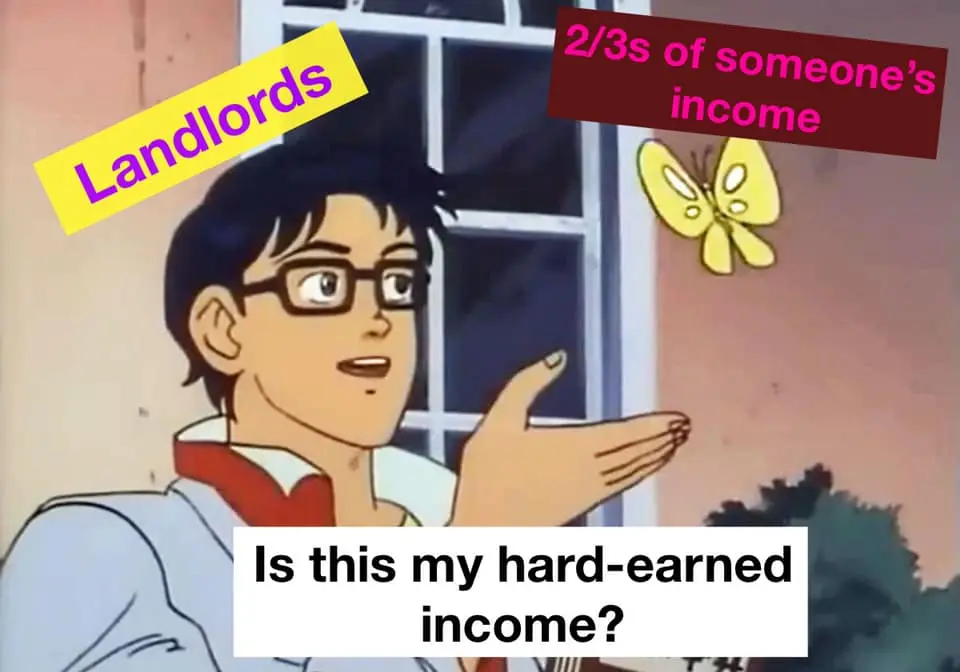

I have seen the amount paid in property taxes in USA via Zillow and... It is HUGE. No surpries that rents are so high. Rent have to cover minimum taxes, maintenance and part of house value. These expenses set the minimum value of a rent. But why you have so high property taxes? Cause enterprieses and billionaires don't pay taxes and cause they put their huge capitals also in real estate, raising the prices. The problem is that real estate is a right ( house ), but also an asset.

Or u know, live in California where the boomer who owns the house is paying 1200 in property tax.

Taxes are astronomical because prices are inflated because of buy-to-rent.

Taxes on single-family residential properties should be like 50% of land value annually for third-homes and up or homes owned by non-human entities. Make it so fucking expensive to own extra houses that they get unloaded cheap to people who will actually live in them, and at the same time reduce the taxable value of the land because it's selling cheap.

Property tax is like 2-3% of the property value in my area, the comment you are reply to is just suggesting making it 50% of the value of the plot annually for people who are buying their third property or commercial buyers.

They are saying that it should be for third homes to discourage owning houses in bulk

No, ey said that taxes should be 50% on the third house (and on, probably), not the first one

A 50% tax on land value would be cheaper than my current tax rate on my home xD

A snake eating its own tail. Lenders keep cranking out cheap loans, inflating the money supply. Buyers keep bidding up prices, inflating the cost of housing. Municipal governments need the extra cash to fight the endless "crime wave" that mysteriously crests every election cycle, so they're always ratcheting up their spending for larger and more comically overequipped police departments. And then we've got another big economic downturn, so its time to lower interest rates and send out a new wave of cheap loans.

Nobody can afford to have housing prices go down. Just look at what that did to the economy in 2008.

The threat of capital flight (which would leave you with a large number of unpaid and extremely irate police officers) means you can't risk upsetting the ultra-wealthy.

And besides, their job isn't to pay taxes, its to create jobs. They employ people in your town and then the employees pay the taxes. The employees get to see their housing prices rise, so they grumble but don't complain too much. And then you have more money to hire more cops to protect against the latest Crime Wave that just so happens to be paired with a wave of housing foreclosures from lay-offs. So its time to clear the streets, re-list the houses at a higher price, and issue new mortgages with another wave of subprime loans.

If you really want to spice things up, maybe we denominate all our accounts in bitcoin, so we can really start speculating.

Many states have tax cuts for living in the property you own. The high tax rate is the state saying “if you make money, we want to make money”.

The problems is that if you live in an house you rent, you have to pay indirectly full property tax. Cause you aren't living in a property you own.

My city* only levies land taxes on investment properties

If you live in your own home, there is no tax

*Canberra, Australia

You are right, taxes are a part of the problem. Home scarcity and the fact that real estate is THE asset are another thing

People called me crazy when I didn't like the fact that they wanted free public transit and for all the bus costs to be put into people's property taxes. My only argument was those that actually need free bus fare, will be unable to continue affording their places they rent because property tax will go up. They will end up paying the same, if not more in the long run..all for free transit. People couldn't grasp it and resorted to verbally attacking me. Lol I still laugh.

I am really not against the idea. The only thing I would say is maybe try it first on areas that are already losing money on mass transit. That way we could massively increase usage. If you are not making money on something stop pretending that you are. NYC system is almost break even so leave that one for last.

Maybe I'm misunderstanding but I don't believe public services should need to break even. They cost money because they're a service

I think it is nice when they do break even. It does cost money and effort to run them. I agree it is not essential that they do but it is nice. Cities have budget crisis if their system is running at cost or near it the chances of it losing funding is lower.

I think the best solution is tax brackets for houses, like we do income. 0.1% for anything under 200,000, .4% under 500,000, and so on. Get that transit fund from those that won't use it anyways but rely on the labor of others to fund their mansions.

The tax bracket is for the landlord, if the landlord pay 0.4% , you pay 0.4%.

Any owner.

What's to stop Trump accounting under your system?

Easy, your insurance policy can't exceed the taxed value.

Transit ideally should be partly funded in the reduced road cost. Less so for buses, but imaging you linked exurbs and outer suburbs to the city by rail and a simple one lane each way road, instead of a five lane each way highway

Taxes do not set the minimum price of rent, supply and demand do that. A real estate investment can still make money even if rental income is less that taxes and maintenance because land appreciates in value over time. This is why the rich invest in it, and why we should tax them where they can't evade it.

the problem is blackrock