this post was submitted on 26 Nov 2023

1098 points (94.0% liked)

A Boring Dystopia

9729 readers

684 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Yes and no.

It's a social safety net. Yes, it can be used as a retirement plan, but it isn't guaranteed and some pensions/retirement plans preclude collection of social security benefits even though you paid in.

My father was a firefighter, and due to his excellent pension he gets like 12 dollars a month from social security. But he's also doing fine because of his pension.

Meanwhile someone who has a catastrophic event in their life but isn't at retirement age may be able to collect benefits.

The biggest problem with social security (aside from the maximum contribution bullshit alluded to in the OP) is that it is treated as a primary retirement plan by most people. That was not its original purpose.

It was also established with a retirement age of 65 when the average lifespan was 63, so even for those using it for retirement. So on average most people didn't live long enough to collect it AND most that did live long enough didn't collect it anyway, AND for those who did, it was only for a few years in average.

But now a majority of Americans are using it for decades. Of course it's running out of money.

I don't think as many people as you imagine are choosing "wow I can't wait to barely be able to afford rent and food when I retire on a fixed income" as a PRIMARY retirement plan. I think a lot of people are having a hard time saving for retirement thanks to inflation and a stock market crash every 10 years, and are grateful that with social security they'll at least have SOMETHING. I wouldn't call that "choosing social security as the primary retirement plan" I'd call that "work your whole life and barely afford to survive when you're too old to work anymore"

I'm not sure that's something to blame or resent people over.

Of course it is. If you as an individual can't accurately predict world economic conditions 40 years in advance, you are a complete failure of a person.

Should be obvious, but since people are stupid, /s

I don't blame or resent people for using social security. I'm just saying the way it is used is not in alignment with the how it was int need, and that disconnect is why it's unfunded.

The cap on contributions should absolutely go away. In fact, it should be made progressive.

Or I’m “choosing” multiple financial disasters (including medical) despite more of a safety net than most Americans have. So I’m way too reliant on SS

Need to have money in retirement to care about the stock market. If you had to liquidate retirement during COVID, yer just fucked. And got fucked for 3 years of "deferred taxes" on the emergency withdrawal as well.

It's funny what a 40 year older will do to NOT have to live on the street when push comes to shove.

That 63 year average lifespan is a bit misleading since, I assume, it is just the mean age at death. It includes infants who die in the delivery room and people who die of untreatable diseases during childhood. It would be more accurate to put the average lifespan of people who made it to adulthood (since they are the only ones who contribute to social security).

That's not why it's running out of money tho. In fact it's not running out of money they just took it and used it for other things like the military.

Social security is not its own fund. It used to be. They stole a bunch of money from it when they merged it into the general fund.

The idea that SS is insolvent is simply a lie.

No I don’t think this is right either. With the boomer generation, SS always had a surplus: more being collected than paid out. Govt financial shenanigans issued debt to let other parts of the govt borrow this “surplus”. However now that the pool of workers paying in is much smaller than retired folk getting paid, that surplus is rapidly turning into deficit: it needs to payout more than it collects.

There’s never been a “fund”, never been “savings”, there’s nothing to “steal”. However SS can no longer meet its commitments (in ten years) so something needs to change

You really need to research. Yes it was its own fund initially.

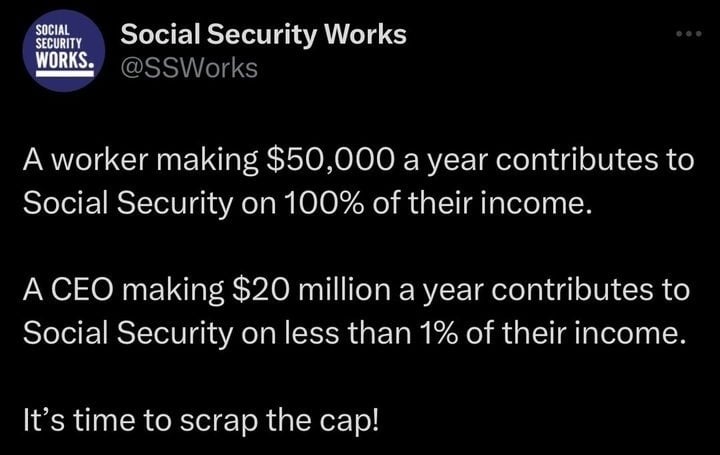

Can you explain what the person in the OP picture is referring to as "the cap"? What is it? How is it defined?

Is it like, up to $x? Or something? For contributions?

SS takes a % of your pay up to a certain amount. I am not sure the "bend points" so I will give fake numbers. Up to maybe $50k per year, you get a very strong "return" for that contribution. Your SS check will be low, but then again, you didn't put in much over your life. Now up to like $100k, you will get a larger check. But not double. From there to like $140k, you still get a larger check, but not 40% more than the $100k.

After $140k, you are no longer required to contribute. With the diminishing returns, it would not have increased the SS check much (if at all) anyways.

What the OP picture is suggesting is to continue to make them pay into SS even though they would get little or no return on it. I see why that makes some sense, but since this is technically not a "tax" but a required pension system, I think they would have to rewrite it all to make sure it was fair that way.