this post was submitted on 20 Oct 2023

27 points (96.6% liked)

FIRE (Financial Independence Retire Early)

1131 readers

2 users here now

Welcome!

FIRE is a lifestyle movement with the goal of gaining financial independence and retiring early.

Flow Charts:

Personal Income Spending Flow Chart (US)

Personal Income Spending Flow Chart (Canada)

Personal Income Spending Flow Chart (Australia)

Personal Finance Flow Chart (Ireland)

Useful Links:

Mr. Money Moustache - a frugal lifestyle blog

Related Communities:

/c/PersonalFinance@lemmy.world

/c/PersonalFinanceCanada@lemmy.ca

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

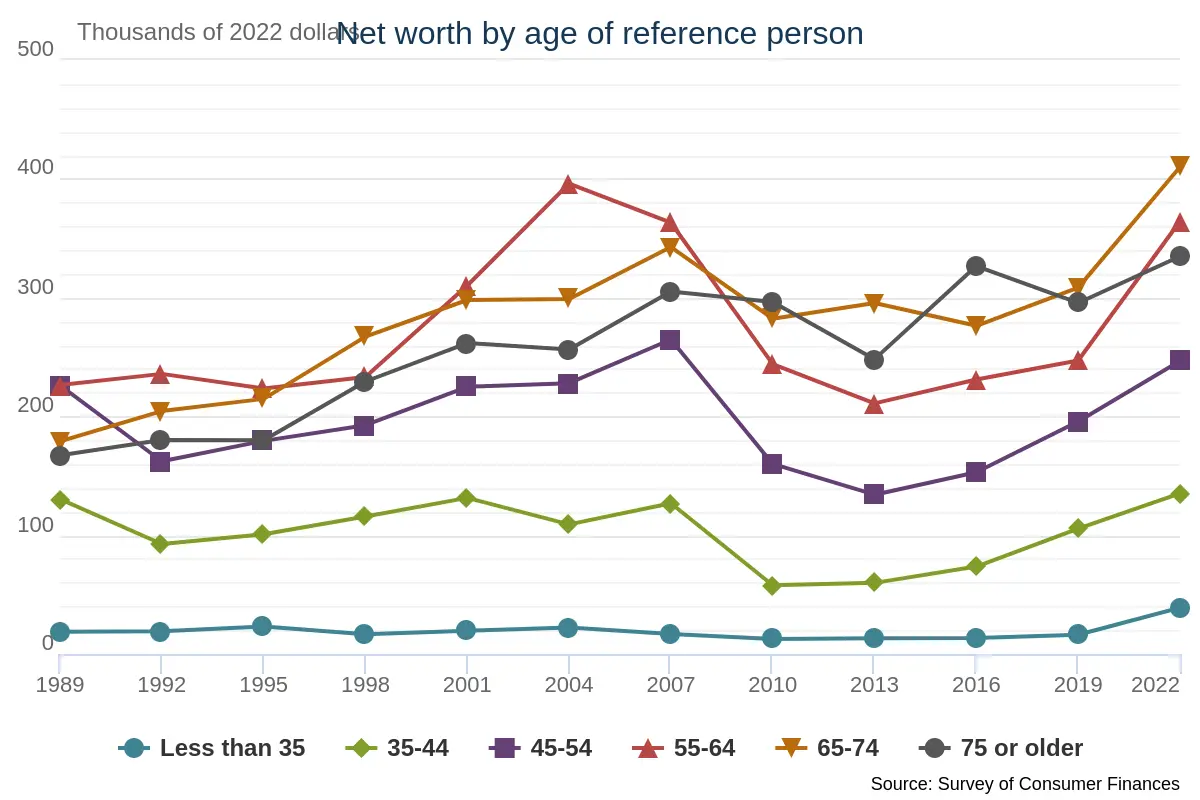

For all of the 50+ having the most, in general, we may just be seeing the baseline principle that time-in-the-market beats other effects.

For why they have more than their 60s and 70s counterparts, I can only guess.

My guess is the 55-64 generation has less conservative investments than their 60s and 70s counterparts, so they raise higher on a strong market, and fall further in a weak market.