They really should tax the fuck out of these.

Housing Bubble 2: Return of the Ugly

A community for discussing and documenting the second great housing bubble.

It’s really really hard to find a place that’s not a complete rip off here

San Diego: City of small "starter" houses built 60+ years ago that haven't been repaired or upgraded since. Expect asbestos, no insulation in the walls, rusted and cracked cast iron plumbing, failing and dangerous wiring, crumbling exterior stucco, water damage in the bathrooms, dry rot in the exterior wood, all for well over $1mm. Oh and your nextdoor neighbor has been living there since the 70s and is paying about $80/mo in property taxes.

You just perfectly described the house I live in and my neighbor 100%

They still mad about the permit they had to get in the 80s? Because man those old folks with the fully owned estates sure held a grudge.

I'm basically trapped in the condo that I bought in 2020 because of the absolutely unexaggerated reality you are describing here.

These days, on Earth? Yup.

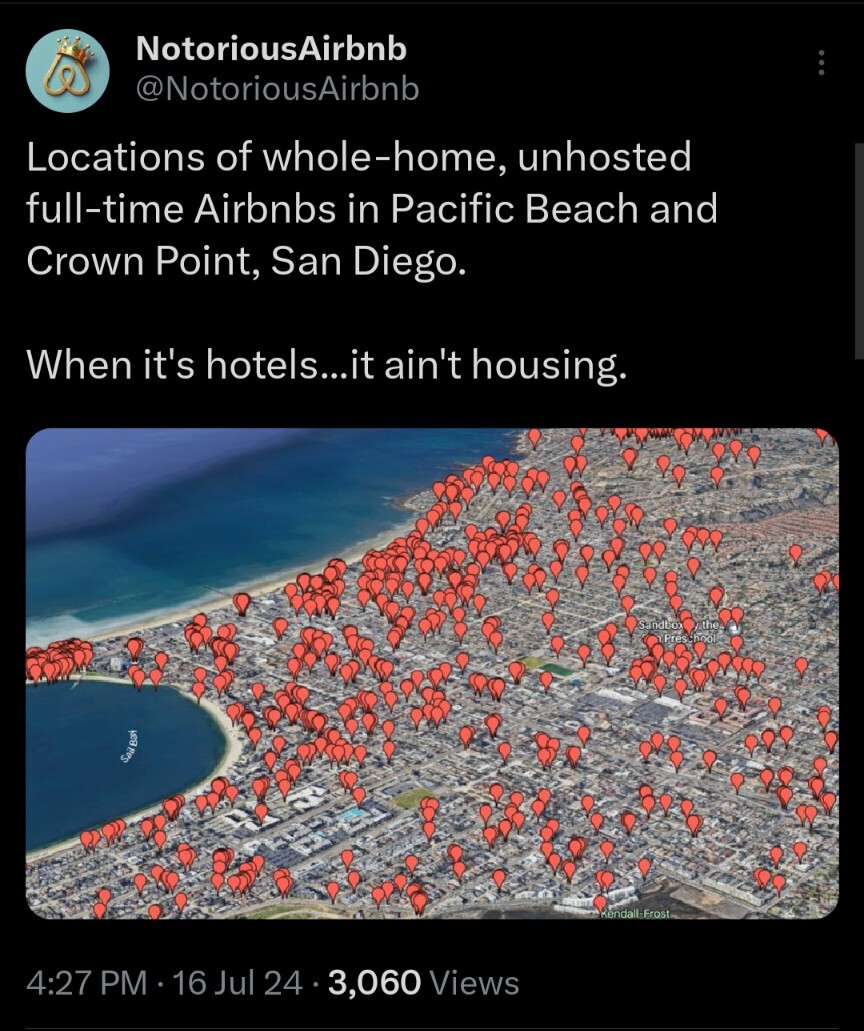

It’s no wonder housing is so expensive.

Real talk, that's maybe, what, 2,000 homes tops? For a really desirable area like San Diego, if you put all of those on the market at once, you'd sate housing demand for like a week. It's not only the homes, it's the density. We need to be building more vertical, it's the only way we're ever going to add enough housing to keep the price of rent attached to the earth.

Housing prices are determined by rent. If you put all those houses in the market not only would it flood the market with inventory. It would dramatically lower the cap rate, i.e. the amount of profit from rent you can get by renting homes. There's a reason why hotels were so heavily regulated before.

For a bit, probably, yeah, but it's really just a temporary measure. We need to be building a lot more housing, like plunking down unironic commie blocks, and doing it consistently to address the housing shortage and keep it from resurfacing.

Realistically that's more like a month to 6 weeks of supply in a market that usually only has 3 weeks to 2 months of supply. It would crash the local market for 6 months, depress it for a year, and affect prices for 2 to 3 years at minimum.

The point is it's a band-aid, not a fix. And what would a depressed housing market look like in San Diego anyway? Probably nothing too accessible, tbh. It seems more likely that the people or investment firms with the assets to would swoop down HARD on that market unless it was part of a broader action at the state or national level, which would quickly provide for a price floor. A proper fix would involve aggressively adding to the housing stock continuously for years and years.