this post was submitted on 01 Aug 2024

1848 points (99.0% liked)

Political Memes

5438 readers

3354 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

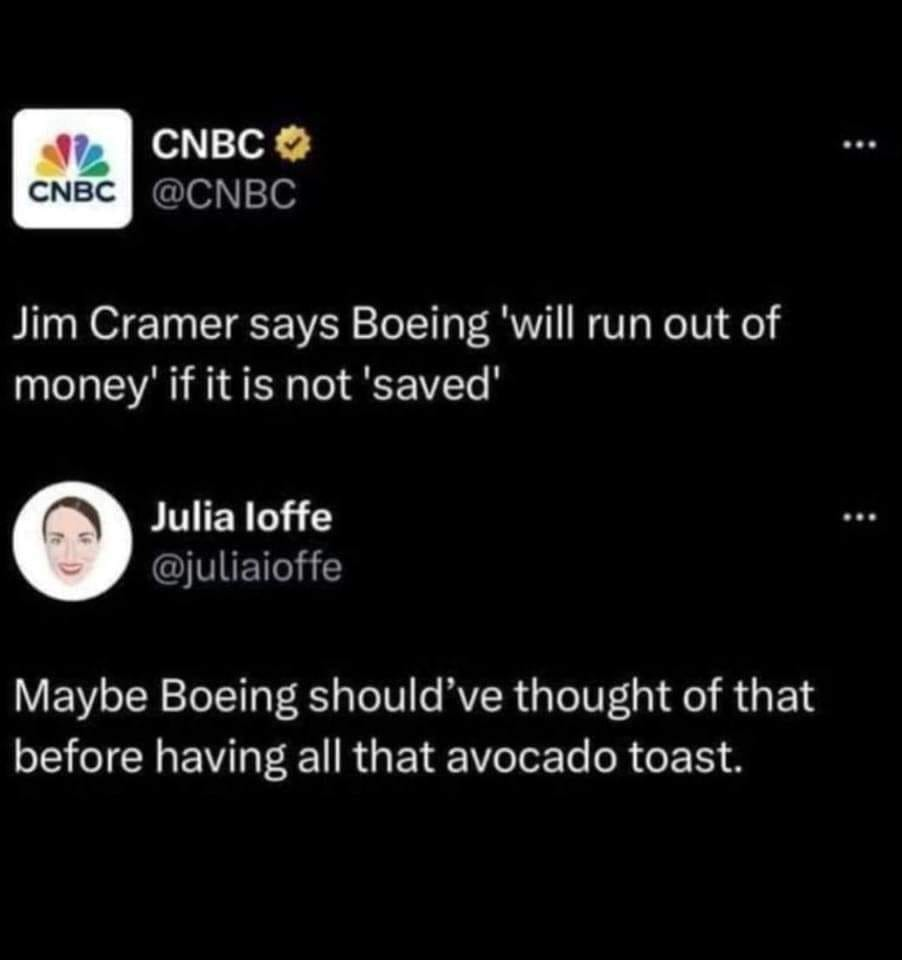

If the only reason you exist is because you're too big to fail, maybe you shouldn't exist?

It's not the only reason Boeing exists. That's the problem. Airframe manufacturing is a critical infrastructure componemt for the nation's airline mass transit network. And there are only two companies in the world that operate at the scale necessary to support the volume of flights.

Boeing can't fail any more than ATT or Citibank can be allowed to fail.

If government has to bail them out, then government gets to nationalize a proportionate amount of the company. And the dividends then go toward government spending.

Something about fiscal responsibility...

And the next government can sell it off for less than they paid for it and the cycle continues.

They shouldn't pay for it, they should just seize it.